greenville county property tax estimator

Greenville TX 75403. No title work after 345 pm in the Motor Vehicle Department.

For comparison the median home value in Greenwood County is 10500000.

. Expert Results for Free. The median property tax on a 14810000 house is 74050 in South Carolina. Learn all about Greenville County real estate tax.

Look Up an Address in Greenville County Today. Left to the county however are appraising property sending out levies making collections enforcing compliance and addressing disagreements. If you have documents to send you can fax them to the Greenville County assessors office at 864-467-7440.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Laurens County Tax.

Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Greenwood County. You can call the Greenville County Tax Assessors Office for assistance at 864-467-7300.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. Greensville County has one of the lowest median property tax rates in the country with only two thousand three hundred sixty eight of the 3143 counties. Lexington County explicitly disclaims any representations and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose.

Any errors omissions or inaccuracies in the information provided regardless of how caused or. Lexington County shall assume no liability for. If the business remits the tax due online the date paid must be January 20 2021 or a date prior to the 20th for the filing to be considered on time.

The median property tax on a 14810000 house is 155505 in the United States. Please call the assessors office in Greenville before you. The median property tax in Greensville County Virginia is 523 per year for a home worth the median value of 94600.

Thank you for your patience while we upgrade our system. Begin Estimating Property Taxes. South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median amount of property taxes collected.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Greenville County. For a list of tax authorities that levy taxes in each district please refer to the Millage Table. Welcome to the Greenville County Geographic Information Systems GIS homepage.

Greenwood County Tax Estimator South Carolina SC. Request Full and Updated Property Records. County functions supported by GIS include real estate tax assessment law enforcement.

Greensville County collects on average 055 of a propertys assessed fair market value as property tax. Greenville establishes tax rates all within South Carolina statutory guidelines. The county is providing this table of property tax rate information as a service to the residents of the county.

For comparison the median home value in South Carolina is 13750000. Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

866-549-1010 Bureau Code 8488220. Real estate assessments are undertaken by the county. Estimated Range of Property Tax Fees.

Easily Find Property Tax Records Online. Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

Ad Get Reliable Tax Records for Any Greenville County Property. Greenville County collects on average 066 of a propertys assessed fair market value as property tax. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100.

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Pay by Phone for Property Tax. Ad Just Enter your Zip Code for Property Tax Records in your Area. If the date paid is January 21 2021 the full 5 penalty will be assessed on the filing.

Another 5 penalty will be assessed on the 1st of each month thereafter until the tax is paid. For comparison the median home value in Laurens County is 8580000. Just Enter Your Zip for Free Instant Results.

Each individual taxing unit is responsible for calculating the property tax rates listed in this table pertaining to that taxing. Often your questions can be answered quickly via email.

Cambria Hotel Greenville Sc Greenville Sc 135 Carolina Point Pkwy 29607

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal

Cambria Hotel Greenville Sc Greenville Sc 135 Carolina Point Pkwy 29607

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Greenville County South Carolina Association Of Counties

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tax Rates Hunt Tax Official Site

Gcs Board Approves Fy 23 General Fund Budget

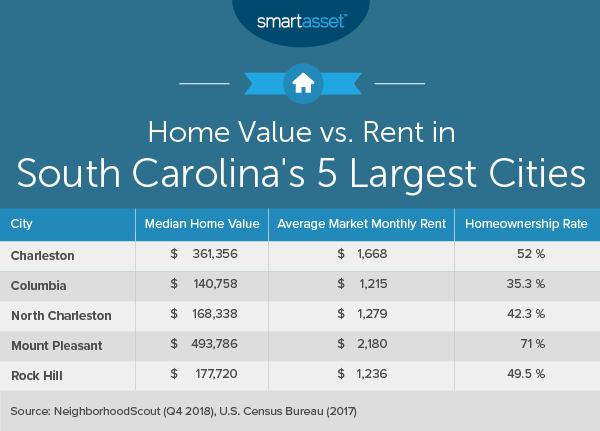

Cost Of Living In South Carolina Smartasset

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders